The term financial inclusion has a wide berth. It is used to describe how inclusive or “open” financial services are to the population at large. Often we think of the bottom of the pyramid and participation in the sector by way of having a bank account, a mobile wallet or even nano-insurance for those at the bottom of Prahalad’s pyramid. But it does infact also apply just as much to the degree that a country’s middle can participate in markets by way of investing in instruments like equities at scale.

Apps like Robinhood in the US and India’s Zerodha have opened up the stock market to retail investors around the world, encouraging them to put their money into stocks and funds by making it simpler to invest. Amongst frontier markets that lie mostly virgin when it comes to penetration of retail investors in the stock market lies Pakistan. The team at KTrade is trying to make a dent in encouraging a greater number of retail investors to take to online stock investment. This nascent market is growing with the rise of Pakistan’s burgeoning middle class and demographic dividend. The country has a population of over 200 million yet only a faction invest in the stock market. There is an opportunity to increase retail investment in Pakistan, as the volume of shares traded on the Pakistan Stock Exchange (PSX) has increased by 7x over the last 18 months. The region is ready for disruption and a number of Pakistani startups have received large amounts of foreign investment into tech-enabled solutions. Notable fintech leader, SadaPay recently raised $7.2m from Recharge Capital and other investors, whilst Tajir, a B2B e-commerce marketplace received $17m in its Series A round. This was led by American venture capital fund Kleiner Perkins just last week and marks the fund’s first investment in a Pakistani startup.

One of the most untapped markets where there is an opportunity to increase retail investment is Pakistan.

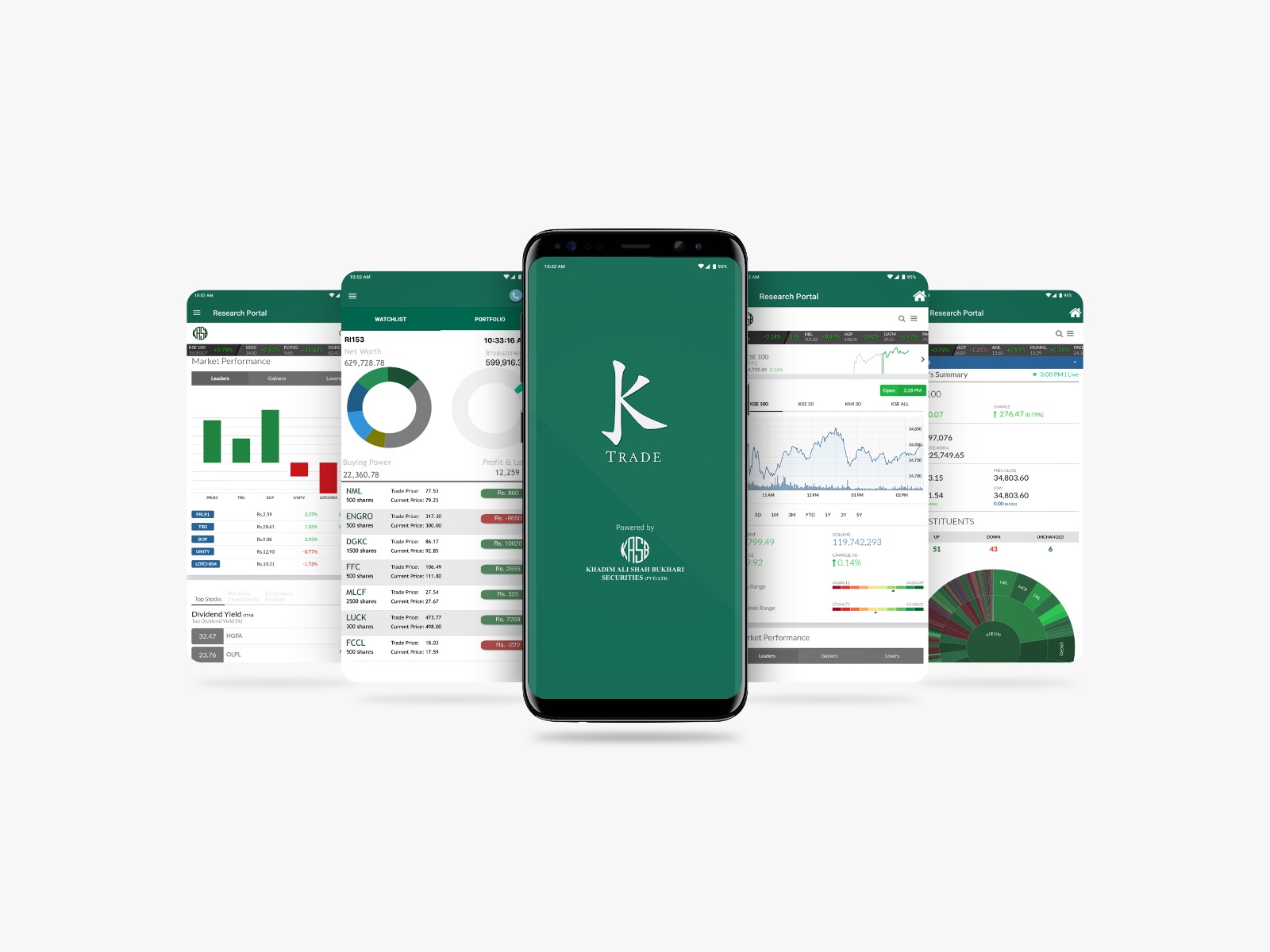

Just this morning, KTrade, which is the retail trading app created by KASB Securities, a leading brokerage house in Pakistan, announced that it has raised $4.5m. The funding round was led by Hong Kong-based TTB Partners, HOF Capital in New York, along with leading fintech investor Christian Angermayer, David Mortlock, Managing Partner of German investment bank Berenberg, and leading Pakistani business families. The majority of investments made in Pakistan are in commodities such as gold or real estate, as opposed to the stock market. However, with a growing middle class and high usage of smartphones, there is scope for technology to facilitate greater financial inclusion. KTrade is trying to push greater retail investors towards capital markets, allowing users to open an account for as little as PKR 5,000 (around $30), with the lowest commissions, access to market research, and dedicated assistance from traders. Founder Ali Farid stated in a press release that “as the regulatory approach, authority and credibility of the Karachi Stock Exchange has grown, more people are getting comfortable with stock market investing.” Although this is a positive sign, gaining access to the market remains difficult for many, and “KTrade will enable this mobile-first population to participate in the investment opportunity. By connecting these people to companies we can drive capital trapped in unproductive assets into the formal economy which would eventually drive a virtuous cycle of economic growth and higher investments” says Farid. The app was launched in 2019 by Farid (Previously CFO of UK-listed fintech company SafeCharge, a Rhodes Scholar and top-ranked Technology Analyst in Europe since 2013) and has seen the number of users rise to 200,000 as of now. The goal is to reach 10million domestic and overseas Pakistanis by 2023 and have them invest in stocks, bonds, commodities, and mutual funds through the mobile app. Investment in KTrade indicates that there is local and international belief in the potential of KTrade’s vision, which is further facilitated by a strong performance by the Karachi Stock Exchange, where retail investors now make up 65% of the overall trading volume. Just 2 years ago, retail investment was 45%. Funding will allow KTrade to continue increasing financial literacy and access to Pakistanis, helping them invest in financial products, which will, in turn, boost the country’s capital markets. Jonathan Bond, Managing Partner of TTB Partners expressed his support for KTrade and Ali Farid, stating that “We have been extremely impressed by what KASB has built over the past few years [and] we believe that in KTrade, the company has a stellar solution to expanding stock market participation across Pakistan.”

How the performance of the market and the region will turn out remains to be seen, however, we are confident that KTrade is well placed to bring more retail investors on board. Will KTrade hit its target of reaching 10million customers by 2023? Given the confidence in the app and the volume of customers that can be reached, we believe that this can be accomplished.